In a significant turn of events, employees of the Consumer Financial Protection Bureau (CFPB) were instructed to work from home as their Washington, D.C. headquarters remains closed until February 14. This directive, disclosed through a memo from CFOB’s Chief Operating Officer, Adam Martinez, reflects the increasing instability surrounding the agency amidst a leadership transition. The situation has left staff uncertain about the future of their roles and the agency’s mandate.

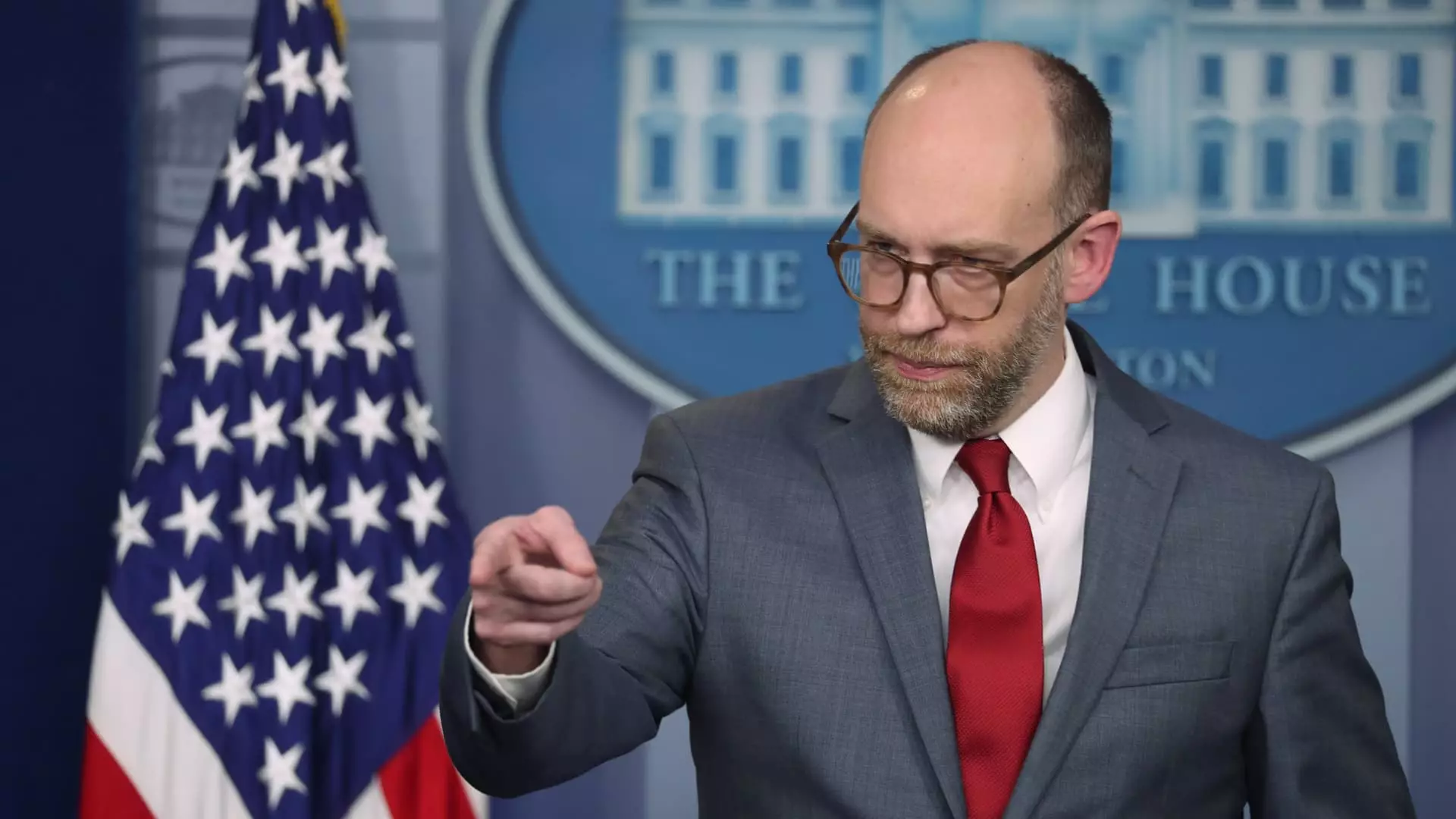

The turmoil began with the appointment of Russell Vought as the acting director of the CFPB. His first orders effectively put the agency’s operations on pause, excluding critical supervisory activities that normally monitor the financial sector. This drastic shift in operations, which was relayed in Vought’s initial communication to the staff, is compounded by apprehensions about the agency’s direction under new management.

Compounding the issue of internal management is the apparent involvement of operatives aligned with Elon Musk, who has previously expressed disdain for the CFPB. Reports indicate that these operatives, referred to as DOGE employees, have acquired access to sensitive CFPB data, including personnel assessments. Such access raises significant concerns regarding the vulnerability of the bureau’s inner workings and the safety of its employees’ evaluations. Musk’s insinuations to dismantle the CFPB have only added to the atmosphere of distrust, as he notably shared “CFPB RIP” with his followers, further amplifying the sense of impending doom for the agency.

Vought’s actions have not only frozen day-to-day operations but have also halted the inflow of funding from external sources, a move he claims will foster greater accountability. However, critics may argue that restricting funding could hamper the agency’s ability to function effectively, leading to detrimental impacts on regulatory oversight of financial institutions. By turning off this “spigot,” Vought instills fear that the CFPB could lose its critical role of protecting consumers from financial malpractice.

The existing environment of uncertainty has also taken a toll on employee morale. Staffers, caught in the crossfire of policy shifts and the chaotic situation, may feel demoralized, anxious about job security, and disheartened by the lack of support from the newly installed leadership. The rapid adjustments can create a chilling effect on productivity and engagement within the bureau, thereby undermining its objectives.

As the CFPB grapples with leadership uncertainty and outside interventions, the future of the agency hangs precariously in the balance. The agency’s ability to fulfill its mandate of consumer protection may be jeopardized, thereby impacting millions of Americans who rely on its oversight. Going forward, it will be paramount for employees and stakeholders alike to advocate for the CFPB’s fundamental purpose, ensuring that consumer interests remain front and center in whatever political landscape emerges.

Leave a Reply