In a startling turn of events, Nvidia has been dethroned from the prestigious $3 trillion market cap club, with Apple now standing as the sole occupant. The recent downturn followed a disappointing earnings report that caused Nvidia’s shares to plummet by more than 8%, resulting in a staggering $273 billion drop in its market value. This crash has redefined the landscape of the tech sector, prompting investors to reassess their positions not only in Nvidia but also across the broader market, which experienced declines in major indices like the S&P 500 and Nasdaq.

Nvidia’s quarterly performance, while initially appearing robust, reveals underlying concerns that could dampen investor enthusiasm. Despite posting a remarkable 78% revenue increase year-over-year to $39.33 billion, the stock still suffered in the wake of uncertainties surrounding global tariffs, export controls, and fierce competition from more efficient AI models. Investors are growing wary, especially considering that Nvidia’s share prices have already slipped 10% since the beginning of 2025, indicating a troubling trend that contrasts starkly with its previous market dominance. While the company’s data center revenue soared nearly 93%, the fundamentals behind this growth are being questioned as fatigue within the AI sector begins to surface.

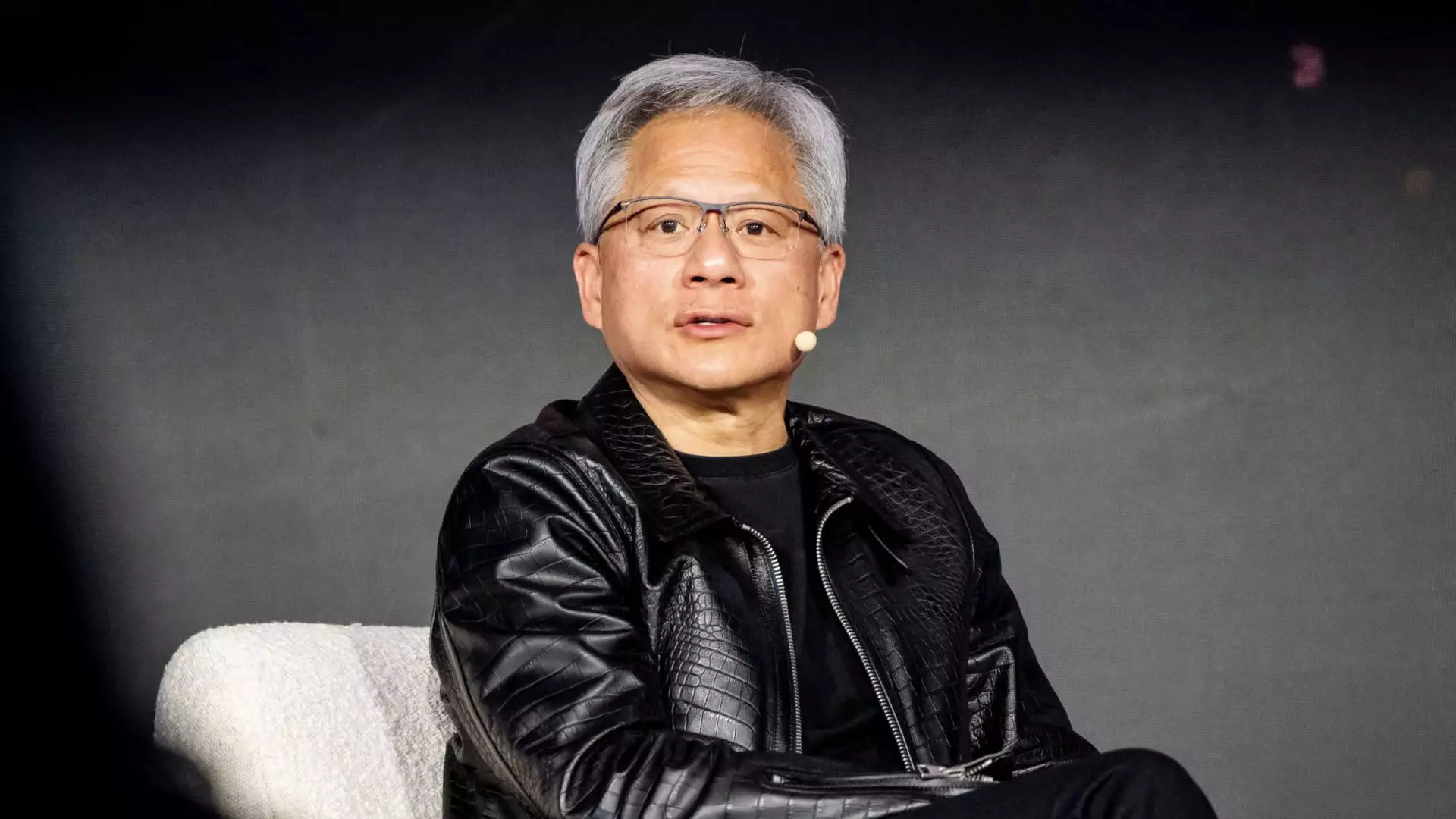

Looking ahead, Nvidia continues to hold a vital role in powering AI with its next-generation chips. CEO Jensen Huang remains optimistic about the demand for Nvidia’s computing power as the complexity of AI models increases. He predicts a substantial requirement for computational resources that could be 100 times greater than previous demands. However, the challenges of production delays, particularly concerning the new Blackwell chip, cast a shadow over this optimism. Despite Nvidia pointing to resolving these production issues, the unresolved concerns about broader economic factors and increasing competition loom large.

Nvidia’s financial health hinges significantly on its ties to major cloud service providers like Microsoft, Google, and Amazon. These relationships account for nearly half of Nvidia’s data center revenue, making them crucial for sustaining growth. If any shifts occur within these partnerships, the ramifications for Nvidia’s revenue could be severe. Large-scale infrastructure investments from these tech giants have become a linchpin for Nvidia, serving not only as a source of revenue but also as a validation of its technological leadership.

As Nvidia grapples with an evolving market landscape, the need for agility becomes imperative. The company’s ability to innovate amidst increasing scrutiny and competition will determine its ability to reclaim its former glory. While Nvidia’s historical performance during the generative AI boom raises expectations, the current realities of market dynamics require a more cautious approach for investors moving forward. The challenges faced by Nvidia not only reflect its vulnerabilities but also point to a broader narrative of volatility within the tech sector, where giants can falter unexpectedly, prompting a reevaluation of what it means to lead in innovation.

Leave a Reply