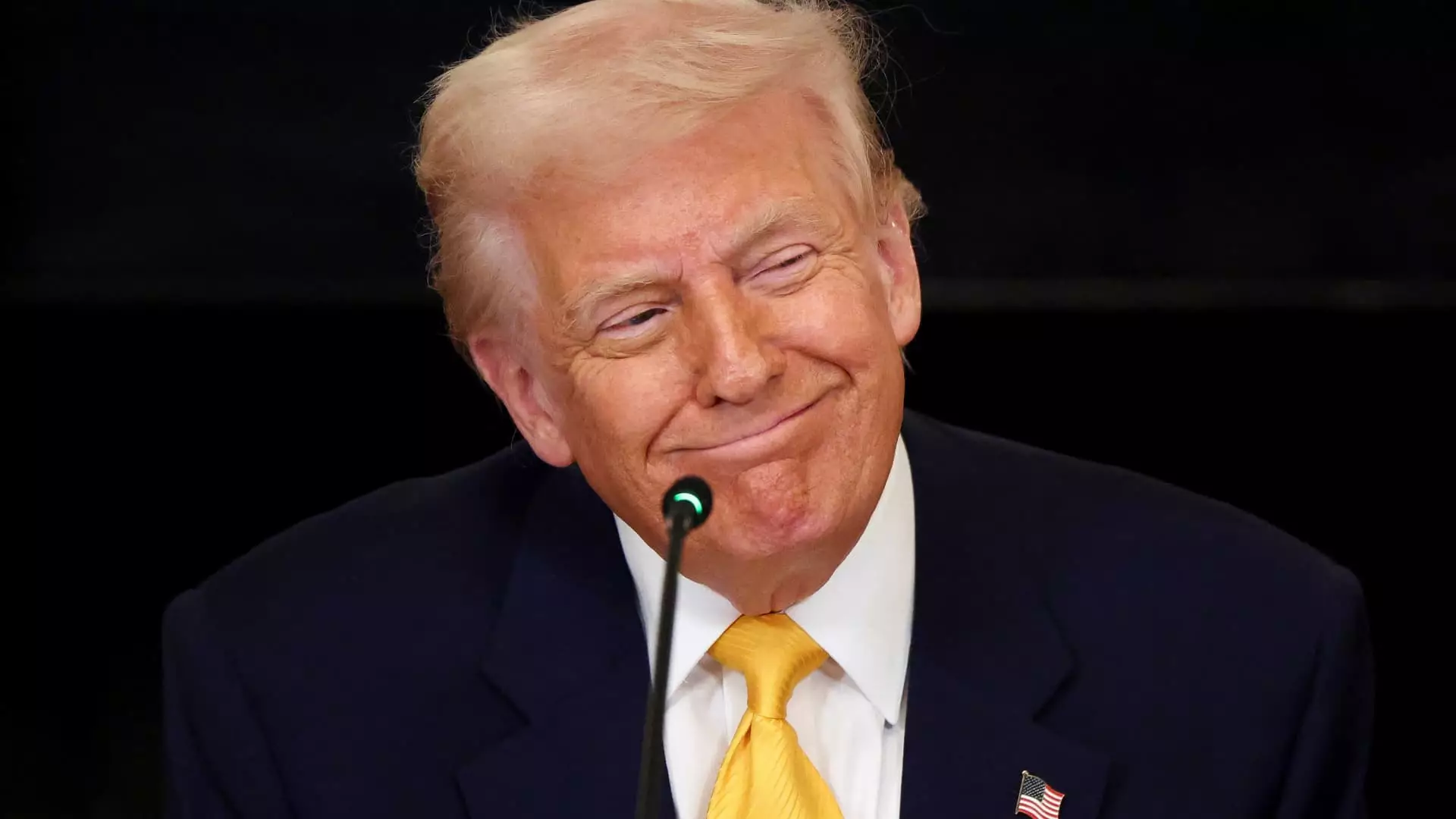

The United States finds itself at a precarious junction under the leadership of President Donald Trump, who remains steadfast in his pursuit of aggressive tariff policies against several trading partners. While he insists this is a strategy to enhance American industry and bring wealth back home, the overwhelming sentiment among economists and businesses is that these tariffs could spell disaster. By treating imports with rash blanket tariffs and dismissing the associated economic risks, Trump risks not only igniting trade wars but also inflicting long-term damage on the American economy.

The Economic Ripple Effect: Ignoring Business Concerns

Trump’s cavalier attitude toward the consequences of his tariffs unveils a troubling disconnect between his administration and the realities faced by American businesses. During a recent interview, he confidently declared that these tariffs would yield significant benefits for the country, despite clear warnings from financial experts and businesses about potential price increases and job losses. The apprehension among companies regarding planning and investment decisions is palpable, yet the president remains almost arrogantly indifferent. Such a mindset threatens stability and breeds an atmosphere of uncertainty that can stifle growth.

Predicting a Recession: The Elephant in the Room

While Trump is seemingly unwilling to entertain the idea of an imminent recession, the facts suggest otherwise. The Atlanta Federal Reserve’s grim forecast of an economic contraction should not be overlooked. Acknowledging the transitional phase that may precede better economic conditions feels like an exercise in hopeful optimism. However, the critical question arises: what if transitional turns into turmoil? Trump’s rhetoric appears to brush off the severity of economic forecasting, fostering a dangerous gamble that could leave millions vulnerable if the economy falters as predicted.

Market Volatility: Playing Roulette with Investor Confidence

The inconsistent approach to tariffs has already led to wild swings in the stock market, causing distress among investors who thrive on predictability and steady growth. Trump’s indecisiveness—lifting existing tariffs only to impose new ones shortly after—has set a precarious stage for Wall Street reactions. Financial stability relies heavily on a consistent and transparent economic policy, yet Trump’s negotiating style leaves investors feeling like they are playing a game of roulette with their portfolios. If companies cannot rely on stable conditions, they are less likely to invest, hire, or innovate, ultimately resulting in slower economic progress.

The Myth of Globalists: Reshaping the Economic Narrative

Trump’s insistence on framing the issue as a battle against “globalists” who have been allegedly “ripping off” the United States is not only simplistic but further complicates an already tangled narrative. While it’s undeniable that trade practices warrant scrutiny, reducing the issue to a blame game ignores intricate global economic mechanics that involve interdependence. The rush to impose tariffs may incite a retaliatory backlash from international partners, further destabilizing an economy that has already shown signs of fragility.

In this tempestuous era of economic policymaking, the blind adherence to tariffs as a solution, paired with a lack of acknowledgment for the potential dangers they bring, requires greater scrutiny. While the allure of bringing wealth back to America resonates with many, the shaky framework of such policies could usher in an era of economic hardship rather than prosperity.

Leave a Reply