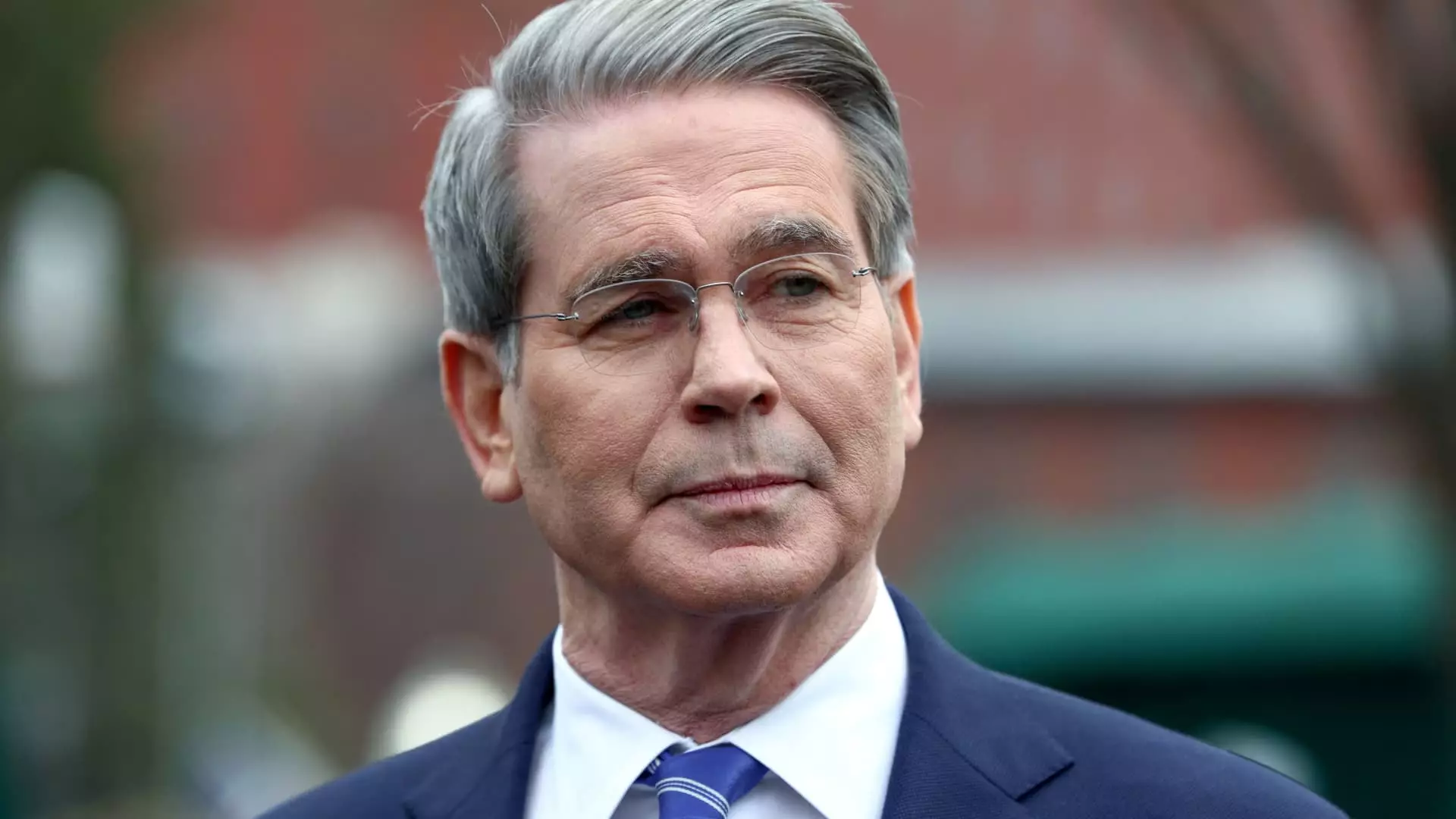

The current assurances being thrown around by figures such as Treasury Secretary Scott Bessent—who categorically dismissed the fears surrounding an impending recession—should be cause for alarm rather than comfort. During a recent appearance on NBC’s “Meet the Press,” Bessent dismissed worries about retirement savings and stock market volatility as a “false narrative.” While his optimistic take may appeal to those aligned with the Trump administration, it belies a more nuanced and concerning economic reality that millions of Americans face, particularly those nearing retirement.

It’s hard to ignore the stark juxtaposition between administration confidence and the anxiety simmering among everyday citizens. More than just vague economic fundamentals, Americans are experiencing a tangible and cascading impact from the recent downturn in the stock market, particularly given that the Nasdaq, Dow Jones, and S&P 500 observed loses reminiscent of the tumultuous pre-COVID landscape. Bessent’s contention that most Americans do not track fluctuations in the market on a day-to-day basis is both patronizing and fundamentally untrue for a populace that is increasingly aware of economic risks. Retirement anxiety is real, and it’s becoming increasingly palpable for individuals whose lives hang in the balance of volatile markets.

The Volatile Landscape of Tariffs and Investments

Bessent’s unwavering belief in the efficacy of Trump’s tariff strategy leaves much to be desired. While calling it an “economic revolution,” the actual results suggest a different outcome. The hasty imposition of tariffs, some up to 54%, seems to present both an economic gamble and a diplomatic quagmire that could ultimately wreak havoc on the very prosperity it purportedly aims to foster. The echoes of Trump’s pleas for buyers and investors to “hang tough” fall flat in a climate where such resilience requires actual cushion—a cushion that many Americans are beginning to realize is dangerously thin.

While Bessent invoked historical parallels to Ronald Reagan’s policies in the 1980s, it is essential to recognize that today’s economic landscape bears little resemblance to that era. Reagan’s measures were countered by an energy crisis and a series of economic blunders that ultimately recalibrated the nation’s economic strategies. It’s difficult for many to equate nostalgia for the Reagan presidency with the current economic uncertainty exacerbated by skyrocketing consumer prices and dwindling purchasing power. Historical analogies can only get us so far; what is required is a decisive and pragmatic approach to contemporary economic challenges.

Blind Faith in Long-Term Economic Fundamentals

Bessent’s assertion that the Trump administration is dedicated to building “long-term economic fundamentals for prosperity” is, at best, overly optimistic. The idea that the American workforce should withstand short-term market fluctuations while placing blind faith in long-term prosperity is a gamble on the good will of policies that seem more reactionary than well-considered. The truth is that focusing solely on the long-term vision while ignoring immediate consequences can lead to disastrous results—a reality that those who remember the 2008 financial crisis know all too well.

Moreover, labeling the trading relationships of the past few decades as “unsustainable” is a two-edged sword. Yes, the dynamics between the U.S. and its trading partners need reassessment. But to brush off years of interdependent economic collaboration as merely detrimental is to simplify a complex globalized economy that cannot simply be re-engineered overnight. A comprehensive reevaluation of trade practices needs to be approached with nuance, not with the bluster of an administration content to maintain a confrontational stance with trading partners.

The Unmet Needs of the American People

At the heart of this narrative is a glaring oversight: the lived experiences of everyday Americans grappling with economic uncertainty. The administration’s top-tier measures and decisions have real implications for those who rely on stable income and robust retirement savings as they age. By waving away concerns about market fluctuations with platitudes and historical references, the administration not only risks alienating those most affected but also tarnishes the very notion of guidance and leadership required in challenging times.

With each passing day, the disconnect between policymakers and the average American grows more pronounced. The message emanating from Washington seems to prioritize political narratives over the voices of the constituents they represent. Individuals nearing retirement age should not have to rely solely on the promise of “future prosperity” while encountering the very present reality of rising costs and shrinking savings. The time has come for economic leadership that transcends political expediency and resonates with the genuine struggles faced by Americans striving to secure their financial future.

Leave a Reply