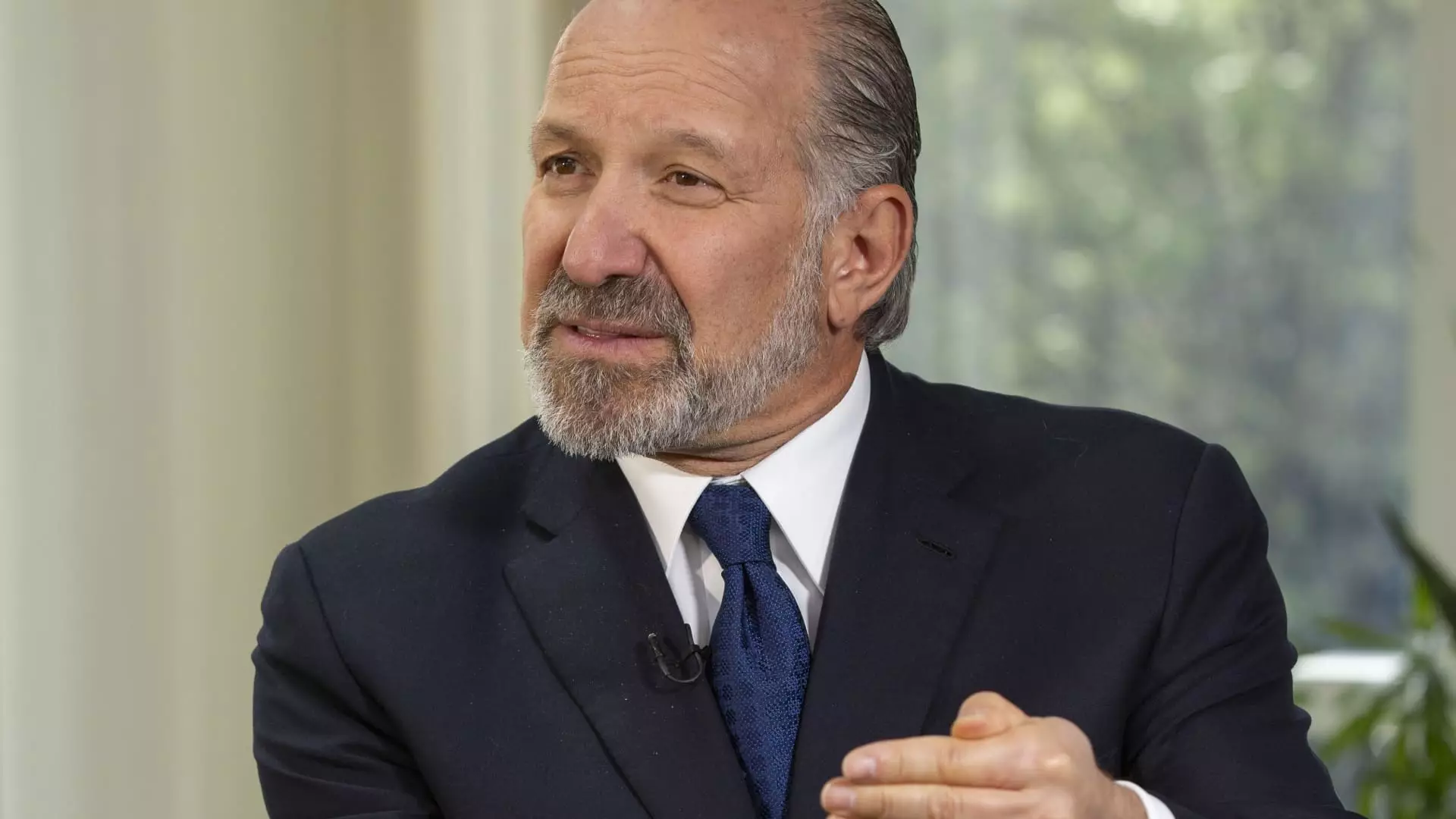

The recent statements by Commerce Secretary Howard Lutnick mark a provocative departure from traditional American corporate assistance. Instead of offering unconditional grants or subsidies to struggling chip manufacturers like Intel, Lutnick advocates for a transactional approach: the government should receive equity in exchange for their investments. This perspective isn’t merely pragmatic; it fundamentally redefines the U.S. government’s role in supporting vital national industries. It raises a core question—are we transitioning from passive benefactors to active shareholders, thereby riskily entangling public resources with private enterprise?

This push for equity stakes reflects a broader desire to ensure taxpayers benefit directly from their investments rather than merely subsidize corporate growth, especially in an increasingly competitive global market. Yet, it’s a move that teeters on the edge of strategic intervention or unnecessary overreach, risking the distortion of market forces. Should government support be tied to ownership, or is this a dangerous precedent that could lead to politicized corporate control?

The Politicization of Industrial Policy: From Grants to Geopolitical Power Plays

Lutnick’s comments hint at a deeper political agenda—particularly the notion that the Trump administration might leverage these deals for broader geopolitical and economic influence. The American investment in TSMC, Intel, and other chipmakers has often been framed as defending national security, but transforming grant dollars into equity stakes shifts this narrative into a potentially dangerous arena of state interference. In essence, we could be witnessing the start of a new era where government involvement in high-tech industries echoes the state capitalism models seen elsewhere, possibly undermining a free-market approach.

This is especially disconcerting considering the current geopolitical tensions with China, which dominate much of the strategic thinking around semiconductors. Does the government’s involvement in chip manufacturing serve solely to bolster national defense, or does it risk politicizing the very industries that must operate with independence and innovation? Turning grants into equity stakes might provide a sense of control but at what potential cost? It could inadvertently foster crony capitalism, where political considerations overshadow technical merit and market dynamics.

Economic Fairness or Opportunistic Power Play?

The assertion that the Biden administration handed out grants “for free” while subsequent deals seek to extract more from recipients encapsulates a narrative of opportunism and fairness. However, this rhetoric oversimplifies the complexities of industrial policy; high-stakes investments inherently carry risks, and public support often requires some form of return or safeguard. Instead of viewing existing grants as “free money,” it’s more accurate to see them as strategic investments in the long-term health and independence of American manufacturing.

Furthermore, Lutnick’s proposal may inadvertently undermine the very purpose of government-supported innovation—encouraging risk-taking and technological leadership without immediate political strings attached. If the government becomes a stakeholder with voting rights or direct control, it risks transforming a supportive role into a meddlesome one, possibly stifling the entrepreneurial spirit vital for breakthrough innovations. Equating government support with profit-sharing might sound appealing, but it invites a dangerous precedent where corporate accountability becomes secondary to political gains.

The Future of U.S. Industrial Strategy: A Balancing Act

As the U.S. invests billions into rebuilding its semiconductor industry, the debate over government equity becomes more than theoretical—it shapes the future of American competitiveness. While fostering domestic manufacturing and reducing reliance on foreign suppliers is commendable, equating public support with equity stakes could backfire, leading to a form of corporate dependency and reduced innovation liberty.

The decision to slow the Ohio factory’s construction under market conditions, combined with aggressive investment and potential government stakes, signals a shifting landscape where the line between support and control blurs. Ultimately, a more balanced approach—one that encourages private innovation while safeguarding national interests—is necessary. Governments must avoid the temptation to weapons-grade their power or micromanage industry development, lest they hinder the very competitiveness they seek to bolster.

By critically examining the push for equity stakes, it’s clear that the U.S. faces a complex crossroads. Entrenching government influence in high-tech industries might seem like a bold move to secure economic sovereignty, yet it risks undermining the principles of free enterprise, innovation, and fair competition that are essential for sustainable growth. The future of America’s chip industry—and perhaps its technological leadership—depends on striking this delicate balance without falling prey to overreach.

Leave a Reply