In recent monetary policy deliberations, the Federal Reserve has demonstrated a concerning inclination towards an overly dovish stance that risks destabilizing long-term economic health. The decision to lower the federal funds rate by a mere quarter percentage point might seem moderate on the surface, but the dissenting voice of newly confirmed Fed Governor Stephen Miran signals a deeper rift in the committee’s strategy—a rift driven by a desire for drastic rate cuts that could undermine the stability of the economy.

Miran’s call for a half-point cut, a notable departure from the consensus, reflects a more aggressive approach that places undue emphasis on short-term stimulus over cautious, data-driven policymaking. While some in the market might view this as an indication of bold leadership, it fundamentally reveals a reckless willingness to sacrifice long-term stability at the altar of short-term relief. The fact that Miran, a fresh appointee, has positioned himself as a more dovish and seemingly more confrontational voice raises questions about the influences shaping his views—particularly given the political context surrounding his appointment.

Political Influence and the Fragile Autonomy of the Fed

The backdrop against which Miran’s dissent unfolds is riddled with political overtones that threaten the Fed’s independence. The Trump administration’s strategic nominations have repeatedly blurred the lines between monetary policy and political loyalty. Miran’s appointment, with overt ties to the White House and the explicit signals from President Trump—calling for significantly lower rates—highlight a troubling trend of politicizing a traditionally apolitical institution.

This recent dissent isn’t merely an isolated policy disagreement; it’s a symptom of an unsettling trend where political considerations encroach upon the core principles of economic stewardship. The Fed, which is supposed to serve as a neutral arbiter focused on long-term economic health, now faces mounting pressure from political actors eager to leverage monetary policy for immediate political gain. Miran’s provocative attitude and the administration’s overt overtures toward rate cuts reflect a dangerous shift where economic decisions are increasingly tethered to political expediency rather than sound analysis.

The Dissenters’ Strategy and Its Risks

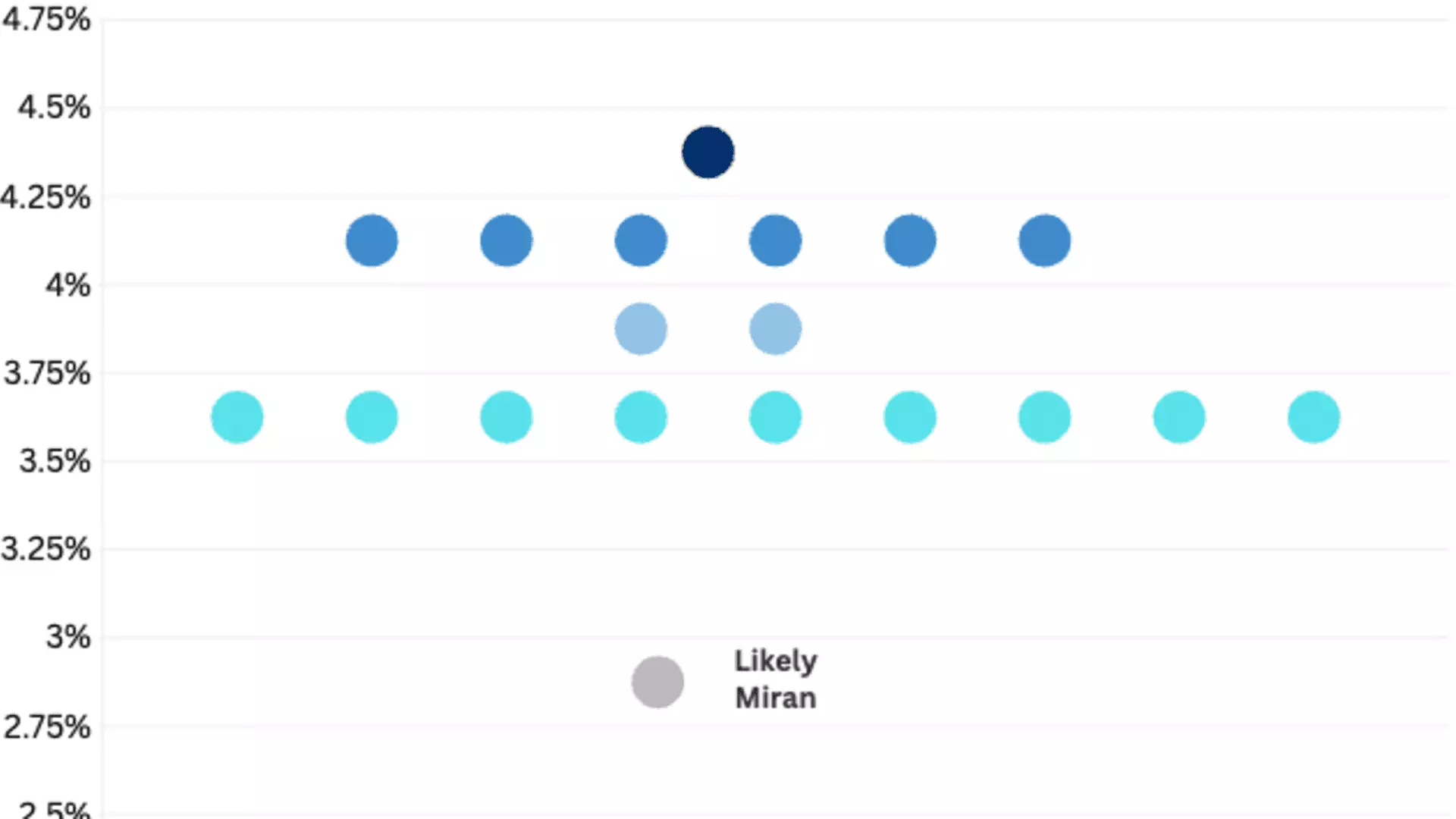

What motivates Miran’s push for a more aggressive rate cut, and what does it reveal about the current state of the Fed? His stance underscores a broader dilemma—whether sliding into overly accommodative policies will ultimately serve the public or set the stage for future crises. The discord among FOMC members about the number of rate cuts in 2026 further illustrates a fractured outlook that undermines the committee’s credibility.

Miran’s alignment with Trump’s demands complicates the Fed’s decision-making process. While some may argue that flexibility in policy is necessary amid uncertain economic signals, the potential consequences of overly aggressive easing—such as inflationary pressure or asset bubbles—are brushed aside. His approach smacks of political pandering rather than prudent economic management, which could erode investor confidence and destabilize markets.

The Broader Implications for Democratic Governance

This internal split within the Fed also ignites a crucial debate about the role of economic independence in a functioning democracy. When political appointees like Miran openly dissent in favor of policies that cater to partisan interests, it undermines the perceived neutrality essential for effective economic governance. Furthermore, the growing association between the White House and the Federal Reserve threatens to erode public trust in this vital institution.

The ongoing controversy over the firing of Fed officials like Lisa Cook and the appointment of partisanship-influenced members exemplifies an alarming trend: the encroachment of presidential influence upon the Federal Reserve’s independence. A politically compromised Fed risks losing its credibility, ultimately jeopardizing the stability and integrity of the financial system.

A Call for Balance and Accountability

As the Federal Reserve navigates tumultuous economic waters, the importance of preserving its independence cannot be overstated. Policymakers must resist the urge to follow the path of least resistance—pandering to political pressures at the expense of sustainable economic growth. Kritically, voices like Miran’s should serve as a cautionary reminder that monetary policy must be rooted in careful analysis, free from undue political influence.

The ongoing ideological battles within the FOMC reflect a broader societal struggle between short-term populist demands and the long-term stewardship of economic health. Recognizing this tension is essential for fostering a balanced approach—one that prioritizes stability, sustainability, and the well-being of future generations over transient political gains.

Leave a Reply