The upcoming UK budget presents a challenging, almost bleak outlook that exposes the fragile state of Britain’s financial stability. According to the National Institute of Economic and Social Research (NIESR), the government faces a sobering shortfall of over £40 billion — a figure that underscores the precarious balance between spending commitments and fiscal responsibility. This gap isn’t just a number; it’s an alarming symptom of deeper systemic issues. The government’s fiscal rules, which mandate that day-to-day expenditure should be fully funded by tax revenue, are poised to be breached by a staggering £41.2 billion in the fiscal year 2029-30. Such a shortfall raises questions about the UK’s economic resilience and the government’s capacity to adapt to an increasingly turbulent financial landscape.

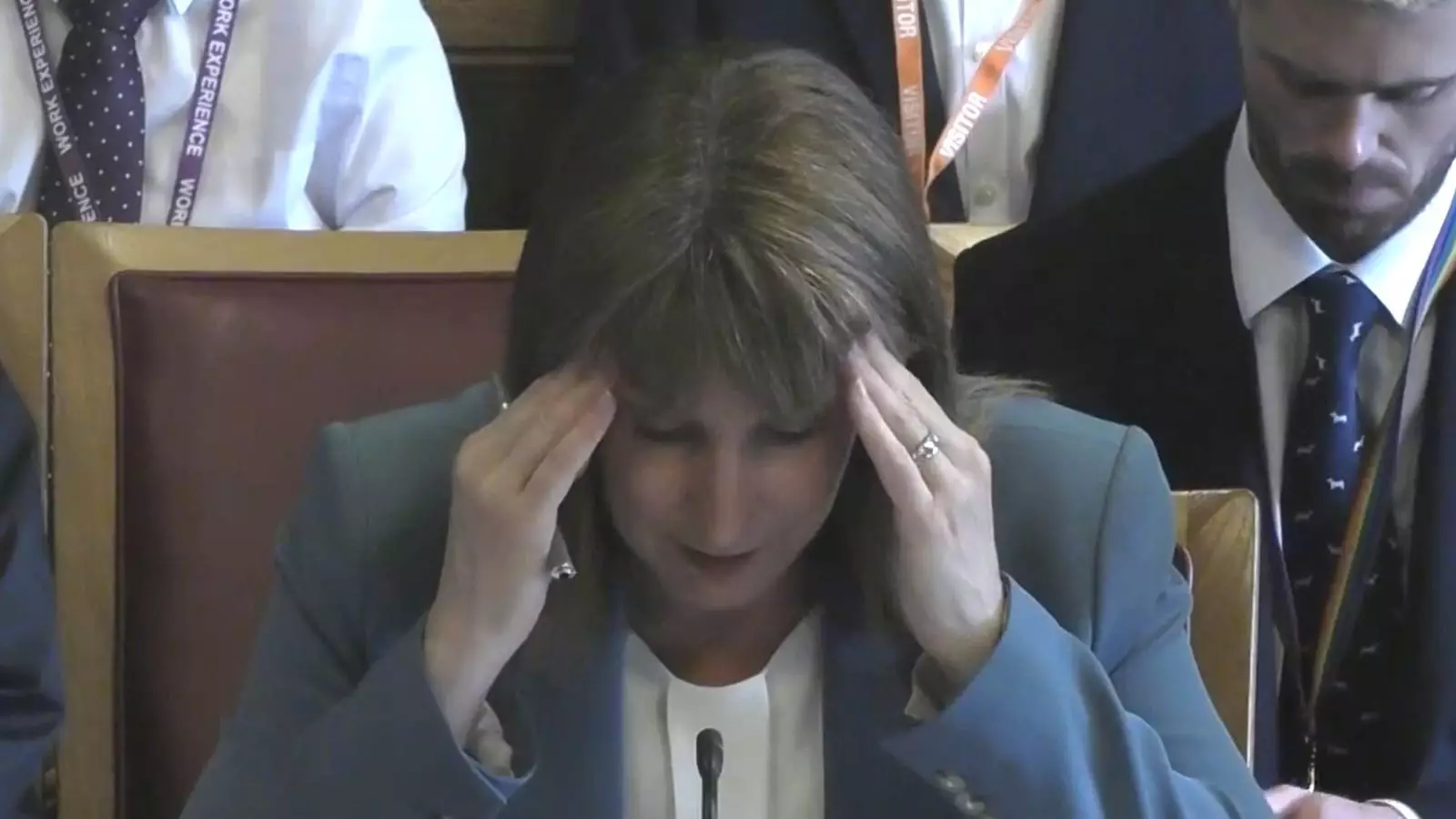

NIESR’s analysis is a stark wake-up call. The country’s economic growth has underperformed expectations, compounded by higher-than-anticipated borrowing costs and the reversal of welfare cuts. These welfare reversals, which could have saved the government billions, now threaten to push the fiscal deficit even further out of control. This confluence of factors creates an “impossible trilemma,” forcing policymakers into a corner where they must simultaneously adhere to fiscal rules, honor spending commitments, and uphold manifesto pledges that oppose tax increases. The situation reflects a fundamental failure of economic management, revealing a government caught between competing imperatives that seem impossible to reconcile.

Tax Increases as a Necessary Evil

The NIESR’s recommendations are both pragmatic and politically contentious. They advocate for moderate but sustained tax hikes, particularly targeting reforms to council tax bands or, more radically, replacing council tax entirely with a land value tax. Such reforms may seem unpalatable to many voters, yet they are presented as essential measures to bolster fiscal stability and reassure bond markets about Britain’s financial sustainability. The logic here is straightforward: by increasing revenue through calculated tax reforms, the government could create a vital fiscal buffer that would reduce borrowing costs and ease financial uncertainty.

However, the challenge lies in the political will to implement such measures. Tax hikes are often met with resistance from voters and opposition parties alike, especially when they touch on property taxes that directly impact middle and lower-income households. Still, the alternative—continued borrowing and escalating debt—risks dragging Britain into a long-term cycle of economic instability, higher borrowing costs, and diminished public trust. The NIESR’s call for reform is not merely about balancing the books; it’s about safeguarding the nation’s financial future in a climate of mounting economic fears.

Spending Cuts or Strategic Investment?

On the spending side, the report pinpoints economic inactivity as a critical area for reform. Cutting waste and encouraging labour force participation are presented as viable strategies to reduce welfare costs, which have ballooned amidst sluggish growth. Yet, this approach raises questions about the government’s willingness to make tough decisions. Sharp cuts to welfare or public services risk alienating voters and undermining social cohesion at a time when inequality continues to widen.

The broader issue is whether Britain should prioritize austerity or strategic investment. In the midst of sluggish growth projections—just 1.3% in 2025 and 1.2% in 2026—the temptation for policymakers might lean toward austerity, trimming spending to meet fiscal targets. But such measures could further depress growth, exacerbate inequality, and deepen the hardship faced by the poorest citizens. Instead, leveraging targeted investments—particularly in education, infrastructure, and skills development—might offer a more sustainable path forward. However, this requires political courage and a long-term vision that many current leaders seem reluctant to pursue.

The Persistent Shadow of Inflation and Living Standards

Adding to the complexity is the persistent inflation that continues to erode living standards. NIESR’s forecasts indicate that inflation will hover around 3% in mid-2026, driven by ongoing wage growth and government spending. This inflationary pressure disproportionately affects the most vulnerable segments of society, with the poorest 10% of households experiencing a 1.3% decline in living standards in 2024-25 alone. This isn’t just a statistical anomaly; it’s a manifest injustice that questions the government’s commitment to economic fairness and social equity.

The Bank of England’s expected interest rate cuts, projected to bring rates down from 4.25% to 3.5%, may provide some relief for borrowers but do little to address the core issue of affordability for ordinary families. The combination of sluggish growth, inflation, and austerity measures risks creating a cycle of hardship for those least able to withstand economic shocks. This highlights the fundamental dilemma of modern liberal economic policy: balancing fiscal responsibility with social justice, all while navigating unpredictable market forces.

The Political Impasse and Future Uncertainty

Ultimately, the UK faces a profound political and economic crossroads. With rising fiscal deficits, stagnant growth, and inflationary pressures, the government must decide whether to accept short-term pain for long-term stability or to pursue populist policies that delay inevitable reforms. As NIESR warns, failure to address these fiscal pressures now will only intensify the crisis in the future, forcing the government into ever more severe choices.

In the context of center-left liberalism, this situation calls for pragmatic leadership—one that recognizes the necessity of fair tax reforms and strategic investment to secure economic sustainability. But with current political polarization and resistance to tough decisions, Britain risks drifting further into uncertainty, where short-sighted populism undermines the fiscal discipline needed for genuine economic renewal. It’s a moment for courage and vision—attributes all too lacking in today’s political discourse.

Leave a Reply