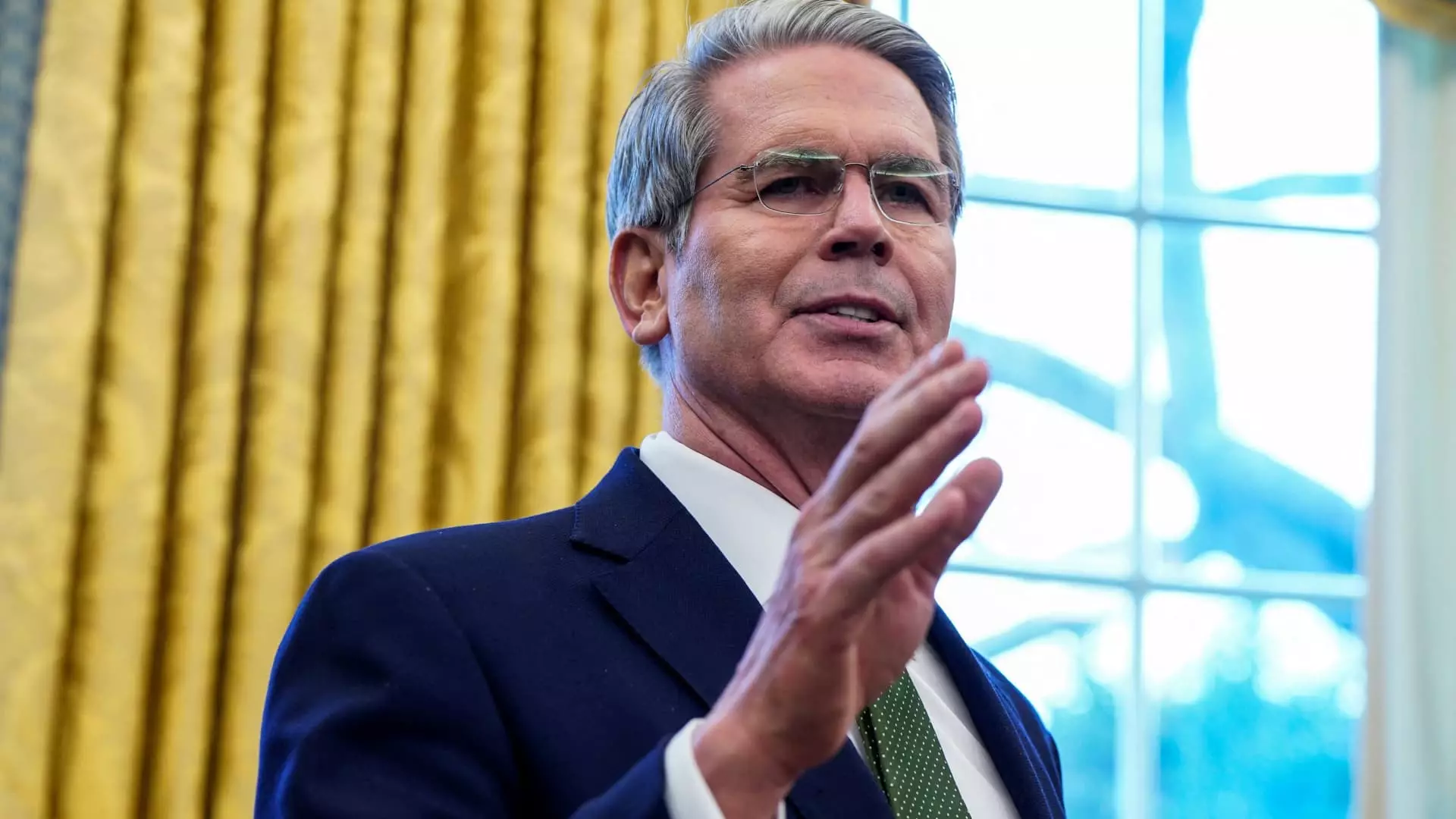

The turbulence of the financial markets often evokes a strategic response from governmental bodies, and the Trump administration’s focus on Treasury yields provides an interesting case study. Under the leadership of Treasury Secretary Scott Bessent, this administration has shifted its attention from the Federal Reserve’s interest rate changes to broader fiscal policies aimed at maintaining lower Treasury yields. This article delves into the implications of this shift, examining its potential consequences for the economy and the political landscape surrounding fiscal and monetary policies.

In a recent interview, Bessent articulated a significant change in approach, highlighting that the Trump administration is now more concerned with the yields on the 10-year Treasury bonds rather than the movements of the Federal Reserve. This shift signals a preference for controlling long-term interest rates through fiscal measures rather than relying on the Fed’s monetary policy dynamics. Traditionally, the Federal Reserve has had a profound influence on short-term interest rates via its control over the federal funds rate, which consequently affects various consumer and business loans. However, Bessent’s comments suggest a pivot away from this conventional understanding, hinting at a more hands-on influence the administration seeks to exert on financial markets.

The central idea here is the administration’s desire for lower borrowing costs, a sentiment echoed by President Trump. By focusing on the yields of Treasury bonds, particularly the 10-year yield, the administration aims to create an environment conducive to economic growth. A lower yield effectively reduces the cost of financing for both consumers and businesses, which could stimulate higher spending and investment.

The backdrop to these strategies includes a recent backdrop of interest rate cuts initiated by the Federal Reserve, which has seen the central bank reduce rates by a cumulative one percentage point. Surprisingly, the market response to these rate cuts was an increase in Treasury yields along with heightened inflation expectations. This paradox raises questions about the effectiveness of the Fed’s approach and suggests potential disconnects in market behavior versus expected outcomes.

As the 10-year Treasury yield fluctuates, the implications for various sectors such as equities and housing become more pronounced. When the yield climbs even slightly, it can signal increased borrowing costs, impacting consumer spending and potentially cooling off significant market momentum. Bessent’s strategic focus becomes crucial, especially in the context of market sensitivity. If Treasury yields were to approach or exceed 5 percent, analysts like Krishna Guha from Evercore ISI warn of potential downturns in equity markets and rate-sensitive sectors such as real estate.

Furthermore, the recent behavior of the 10-year Treasury yield, which dropped to 4.45% after peaking at 4.8% in January, hints at the ongoing tug-of-war in the financial markets. The administration’s ability, or inability, to sustain lower yields will have ramifications for broader economic conditions.

Fiscal Policy as a Lever for Economic Growth

The Trump administration’s broader strategy aims to utilize fiscal policy as a critical lever to boost economic growth. Bessent indicated that a primary goal is to make the Tax Cuts and Jobs Act permanent, alongside an emphasis on energy exploration and efficient government spending. This comprehensive approach reflects an understanding that economic stability and growth do not solely depend on interest rates but also on governmental efficiency and regulatory reform.

The underlying belief is that if deregulation occurs and procurement processes are streamlined, then lower interest rates will transpire naturally, promoting dollar stability and consistent market performance. Adhering to these policies suggests a potential long-term strategy that transcends typical reactive measures often employed in economic policy.

The Trump administration’s focus on controlling Treasury yields rather than relying on Federal Reserve actions signifies a paradigm shift in economic policy. By emphasizing fiscal strategies aimed at lowering Treasury yields, this approach delivers a distinct economic philosophy rooted in deregulation and efficiency. While this ambition holds promise, the effectiveness of such a strategy will largely depend on market responses and the intricate balance between monetary and fiscal policies. As uncertainty in global markets persists, the ability to navigate these changes will be critical for continued economic progress.

Leave a Reply