In a tumultuous week for the stock market characterized by a staggering decline driven by geopolitical tensions and a torrent of aggressive tariffs, Warren Buffett’s Berkshire Hathaway emerged as an unlikely beacon of stability. While the broader indices like the S&P 500 and Nasdaq Composite were ensnared in a sharp downturn, Berkshire’s performance remained a topic of interest among investors seeking refuge from the economic storm. The company’s Class B shares only witnessed a 6.2% drop, a comparatively muted response when placed beside the S&P 500’s 9.1% nosedive and the tech-heavy Nasdaq’s devastating 10% decline.

What sets Berkshire Hathaway apart is not merely its ability to weather financial tempests but its structural integrity. With a diverse portfolio that includes heavyweights in the insurance, manufacturing, energy, and retail sectors, the conglomerate has crafted a model that detaches itself from the erratic fluctuations of a market swayed by political winds. This economic insulation makes Berkshire an appealing option, particularly against the backdrop of a partisan landscape increasingly defined by uncertainty.

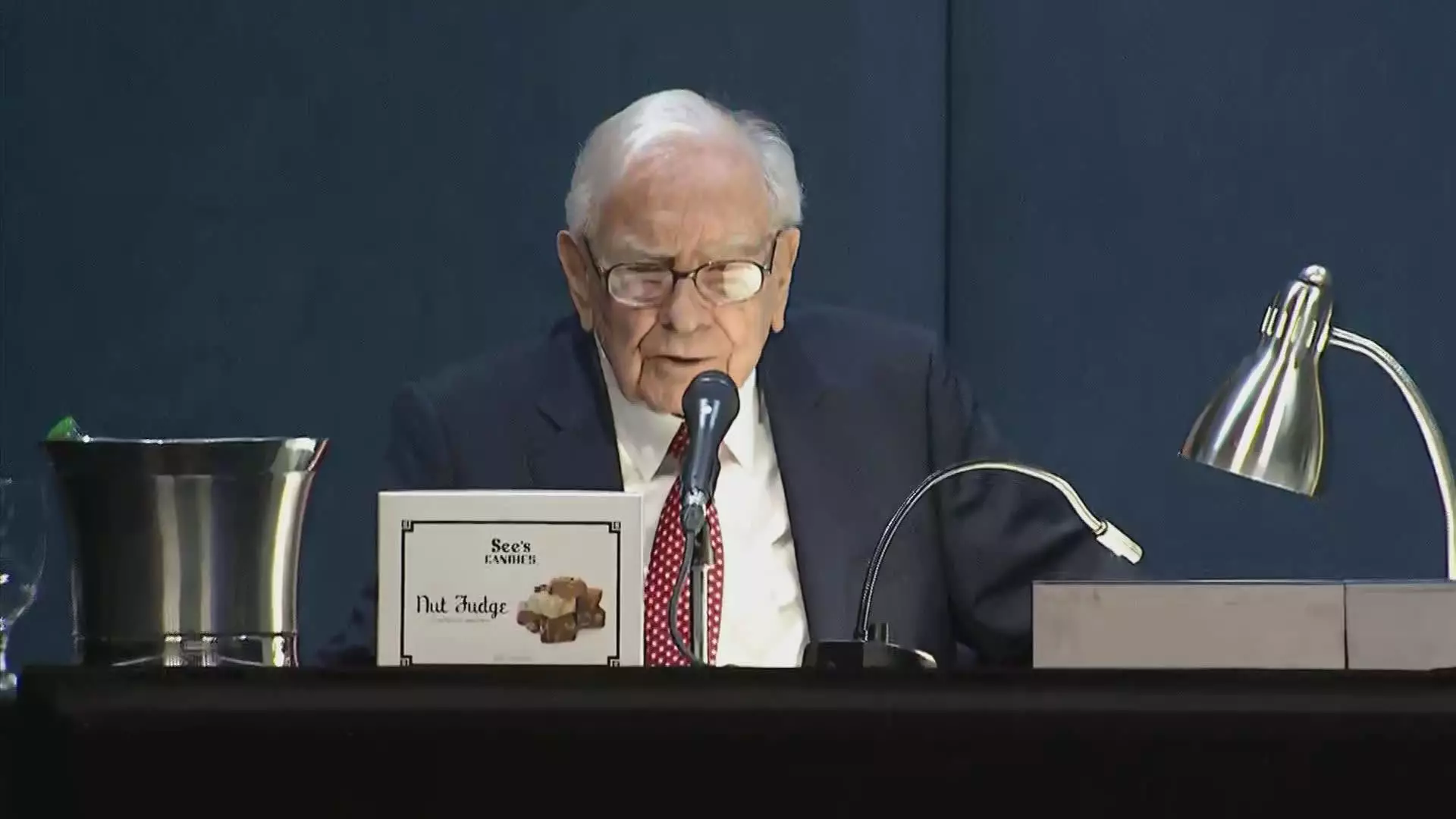

Buffett’s Fortress: Cash and Confidence

At the heart of Berkshire Hathaway’s allure lies its impressive balance sheet, showcasing a staggering $334 billion in cash reserves at the end of 2024. This significant capital cushion affirms the company’s strength against external shocks and provides a runway for future investment opportunities. In a market rife with volatility, the company’s formidable liquidity not only embodies safety but also instills confidence in investors who might otherwise feel cornered by rapidly changing economic dynamics.

Berkshire Hathaway’s stability is particularly noteworthy amidst President Donald Trump’s aggressive tariffs, which have incited fears of a global trade conflict. As the market reacts to these shifting tides and the specter of a trade war looms, Berkshire becomes a rallying point for investors who prefer solidity over speculative plays. Ritholtz Wealth Management CEO Josh Brown succinctly encapsulated this sentiment, asserting that Berkshire remains uncoupled from the whims of political machinations, making it one of the few stocks able to stand on its own merit in this volatile landscape.

Political Friction and Market Realities

There’s a deeper commentary at play here: the intersection of corporate stability and political unpredictability poses a challenge for investors seeking to navigate this uncertain terrain. How much should a company’s fortunes be tied to the fickle policies of a president whose strategies can shift overnight? In the case of Berkshire, the consensus seems to suggest that its intrinsic value transcends the pitfalls of political maneuvering—an essential quality in an age where political agendas often send ripples through the markets.

As Trump’s administration continues to exert influence over several sectors, the financial ecosystem remains fraught with tension. Investors are increasingly engaged in a balancing act, weighing the perceived risks against potential rewards. What differentiates Berkshire is its historical resilience—a characteristic steeped in decades of astute management and a diversified narrative that permits it to sidestep the typical pitfalls encountered by more vulnerable counterparts.

The Buffett Code: Perception vs. Reality

Adding another layer to this discussion, the recent controversy surrounding Buffett’s alleged remarks on social media further highlights the churning currents of misinformation that permeate the current political climate. When Trump asserted, without substantiation, that Buffett was complicit in a narrative designed to diminish investor confidence, it underscores the tension between public perception and the grounded realities of investing.

In navigating these turbulent waters, investors should prioritize discernment and critical thinking. The opinions—whether grounded in fact or fabricated—should not dictate investment decisions. Instead, the focus should rest firmly on a company’s fundamentals, as exemplified by Berkshire Hathaway. This company’s ongoing success is a testament to the efficacy of maintaining a long-term perspective, despite the surrounding noise.

In an era where sensationalism often overshadows substantive analysis, Berkshire Hathaway remains a bastion for those who seek both safety and growth in their investment choices—a microcosm of resilience against a broader landscape rife with uncertainty.

Leave a Reply