In the world of finance, where uncertainty often reigns supreme, a few stocks are shining as beacons of potential growth. According to Bank of America analysts, companies like Nvidia, Amazon, Netflix, and Boot Barn are not just doing well; they’re on trajectories that suggest even greater heights. This analysis naturally invites skepticism—how much of it is just market noise versus genuine opportunity? Yet, the arguments laid out for these firms cannot be ignited without some consideration of broader economic implications. In a landscape where technology is the pulse of innovation, companies that can adapt and foresee trends will not just survive; they will thrive.

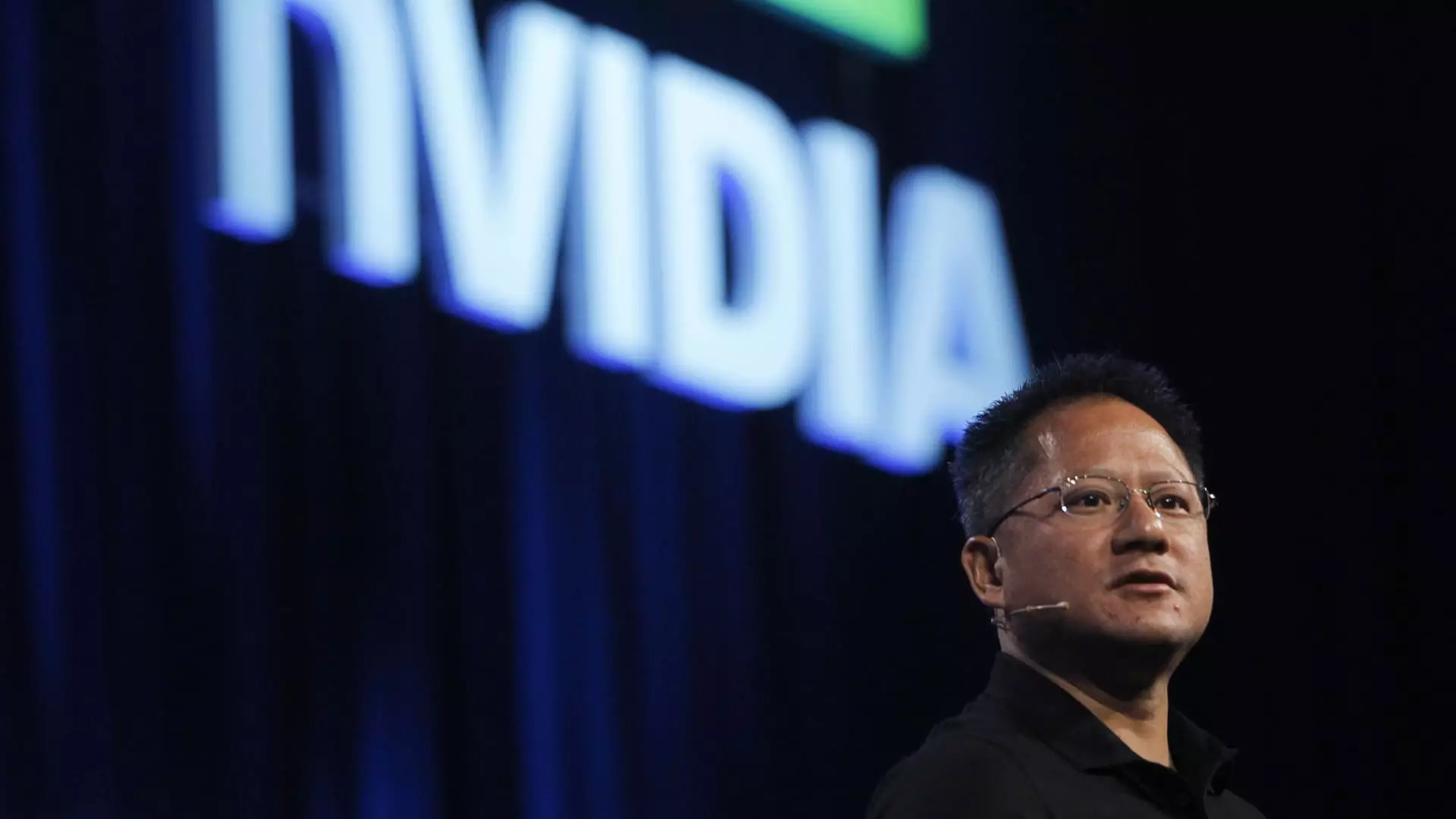

Take Nvidia, for instance. The firm is being touted as a leader in AI technology, which is becoming increasingly critical across industries. With a price target set to rise amidst ever-increasing demands for its GPUs, this stock exemplifies what’s driving the tech industry forward. Analysts emphasize Nvidia’s significant footing in AI, suggesting that its performance continuity is more than just a product of good fortune. Still, while I’m optimistic, I can’t help but wonder: is our fascination with AI leading to an overvaluation that could backfire when reality sets back in?

Streaming to Success: The Netflix Phenomenon

Next up is Netflix, which seems to be conquering the streaming wars with commendable vigor. The company’s recent performance has prompted analysts to raise their price target significantly—to a staggering $1,490 per share. This ambitious target echoes the optimism rooted in subscriber growth and an expanding portfolio of advertising and sports content. The fact that Netflix has seen a 39% rise in its stock this year hardly surprises me when one considers the sheer scale and might of its content production.

Yet, there’s an underlying current of concern. Can Netflix maintain this momentum amid escalating competition? The tech giants are diversifying into streaming, and too much reliance on subscription growth could prove precarious. The advertiser’s dependency it’s cultivating is a double-edged sword. I question whether Netflix’s model is as bulletproof as it seems, or if it’s simply poised for a market correction down the line.

The Retail Renaissance: Boot Barn’s Unique Position

Moving beyond tech, Boot Barn has garnered attention for its impressive performance in the retail sector. The company, specializing in Western-themed footwear and apparel, has seen a surge in its stock price driven by positive trends across various categories and regions. Analysts suggest this has the potential to create a multi-year growth story. Their assessment hinges on the notion that as the company scales, enhanced pricing, selection, and customer service contribute to its attractiveness.

However, here’s where my skepticism kicks in. While the resurgence of uniquely marketed retail stores can certainly capitalize on niche markets, we must also factor in the broader economy’s condition. Consumer spending is fickle, especially when inflation and economic circumstances dictate a tighter budget. Without a robust, multi-faceted strategy, Boot Barn, however promising, could face headwinds that undermine its current momentum.

Amazon: The E-commerce Goliath

Then there’s Amazon, the omnipresent giant in e-commerce, stirring waves of excitement with its aggressive integration of robotics and technological innovations. Analysts are heralding its new price target of $248 per share, grounded in increased operational efficiencies. With the company effectively leveraging robotics to maintain its competitive advantage, Amazon is completing a cycle of dominance in not just shopping, but cloud computing and advertising as well.

Yet, I can’t overlook one critical aspect that analysts seldom mention: the human cost. As Amazon advances its automation strategy, we must scrutinize the social implications of reduced labor dependency. Will job displacement create societal rifts that could eventually harm consumer spending power? Is there a plan in place to train workers displaced by robots, or is this all happening while the workforce looks on with skepticism? These are essential considerations that could significantly impact Amazon’s long-term prospects, beyond just stock valuations.

The Dark Side of Investment Buzz

While the articles and opinions floating around regarding these stocks brim with confidence and dizzying valuations, readers must exercise caution. The financially driven narrative often eclipses real-world concerns. The intertwined realities of market volatility and social dynamics call for a balanced perspective; a sweet spot between enthusiasm for innovation and pragmatism about potential pitfalls.

In the grand tapestry of investment, as certain stocks rise like meteors, one must wonder about the inevitable corrections that lie ahead. Is this investment landscape a thrilling ride or a dangerous gamble?

Leave a Reply